The green transformation of our economies depends on getting more funding into the hands of aspiring green entrepreneurs. It is critical that the people behind all the best and innovative ideas have the tools to successfully navigate the often complex funding process.

At Kumēia, we want to support green entrepreneurs to effectively communicate their ideas and business model to potential investors. We are building a network of experts on both sides of the funding process – from experienced green entrepreneurs, who have secured funding from public and private sources, to fund administrators familiar with the various selection policies and criteria.

In this article, we provide an overview of three separate funding schemes operating in the EU, UK and Switzerland. The overview aims to answer pertinent questions about the objectives and prior success of each scheme. We also present feedback and tips about filing a strong application.

Energy Entrepreneurs Fund, UK

The UK government has recently completed a call for applications for the ninth round of the Energy Entrepreneurs Fund (EEF). Since the EEF’s launch in 2012, the fund has awarded more than 100 million pounds to green projects which are helping to drive revenue and innovation across the green sector.

Each round of funding the EEF will provide grants for between 15 – 20 green projects from a pot of approximately ten million pounds. The total sum of funds for each successful applicant depends on the strength of idea and potential market value. However, in some cases, a single project has received over one million pounds.

The scope and purpose of the EEF is similar to that of other funding schemes, including the other two which we will feature. The EEF is looking for entrepreneurs with ideas relating to energy efficiency, power generation, heat generation, energy storage, reducing greenhouse gas emissions and security of supply.

Who is eligible?

Location

The EEF naturally wants to target funding towards projects which advance UK climate and economic goals. Therefore, applicants with operations based in the UK will likely have a greater chance of securing a grant. However, hybrid companies are permitted to apply. The project guidelines state that at least 50 percent of a project’s operations must take place within the UK, excluding overseas territories.

Innovation test

This is the key moment in any application process and it separates the failed candidates from the successful ones. You will need to provide evidence that your project is distinct and has the potential to outperform the competition in the same market.

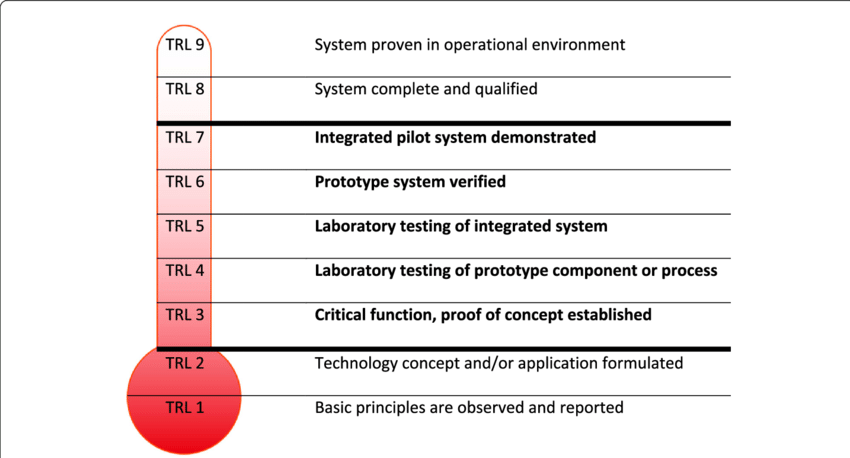

The EEF uses the Technology Readiness Level (TRL) to understand the technical robustness and commercial fitness of a new project. The TRL, as seen below, is a scale representing the ‘maturity’ level of a piece of technology. For example, at TRL 1, a project is only taking shape through research and development. Whereas at TRL 9, the technology has been created and has passed a trial mission to mimic its real-life use.

Researchgate.net 2018

For EEF applicants, your project will need to be at or somewhere between TRL 3 – 8. If your project sits at the lower end of this scale, such as TRL 3, this won’t count against your funding proposal. No preference will be given to projects that are closer to fully operational.

Extra funding requirements

The EEF will not provide all of the funding to cover operational costs. The fund wants applicants to match its funding with outside investment. This investment has to come from private investors rather than another public body.

To prove you have a second source of funding, you will need to include an investment plan which identifies all investors and displays their commitment to your project until it becomes independently viable.

Candidate profile

The EEF guidelines suggest that the fund is open to a wide range of groups and enterprises including startups from the private sector to public bodies such as universities operating in a consortium. However, the fund tends to favour small to medium sized enterprises (SMEs), and encourages these groups to apply. The fund defines small businesses as organisations with fewer than 50 employees and nine million pounds of annual turnover. Medium sized enterprises can have up to 250 employees and 45 million in turnover.

Notable past applicants

Last year, Nova Innovations, the Scottish-based tidal technology company, announced a funding partnership with the EEF, valued at £800,000. With this financial injection the firm aims to develop their CREATE project. Through the CREATE project isolated communities will be able to transport and maintain tidal turbines on their coastline in a more cost effective manner.

For more information on the EEF, check out these resources:

https://www.gov.uk/government/publications/energy-entrepreneurs-fund-phase-9

EU Innovation Fund

The Innovation Fund is a part of the EU’s Green deal and is the largest green funding program operating in Europe.

The EU hopes to award a total of 38 billion in funding to green entrepreneurs before 2030. However, the final figure might fall short of this target because the fund is dependent on revenue from the sale of carbon credits on the carbon market (EU ETS). If the price of carbon drops below 75 Euro per ton of CO2 then the ambitions of the fund will have to be scaled back (EU Commission, 2022).

Who is eligible?

Location

The Innovation fund is available to green entrepreneurs across all EU member states as well as the EFTA countries, Norway and Iceland.

Candidate profile

The financial power of the EU Innovation fund dwarfs the EEF in the UK. This means that the fund can actively encourage large companies to submit applications for flagship projects which carry a high level of risk. The fund also supports smaller scale projects with total capital costs of under seven and a half million euros.

In addition to scale, the fund has the capacity to support projects with multiple cross-sector objectives. During the last funding call the Commission published data relating to the sector breakdown of each submitted application (EU Commission, 2022). The data revealed that over 50 projects aimed to develop at least two different types of product such as bio-based products and e-fuels.

Funding application process

The Innovation Fund selects applications based on five main criteria.

- The degree of innovation

- Greenhouse gas avoidance

- Project maturity

- Cost efficiency

- Scalability

A panel of six experts assesses all the applications, checking to see if they fulfil the criteria. The panel consists of two greenhouse gas emissions experts, two technical experts and two financial experts. The EU says that犀利士 the work and process of assessment follows standard practice and strategy typical in private sector investing.

Tips for a successful funding application

The EU has published a paper which includes observations and feedback from the first funding call for both small-scale and large-scale projects. Here are a few choice findings which should help new applicants avoid the mistakes of previously unsuccessful candidates:

Tip 1 – Make sure your project is unrivalled

The fund is looking for projects that represent a market shift in terms of innovation rather than a small step. To show that your project is sufficiently innovative, you should perform a direct comparison with at least two other ‘state of the art’ products currently available on the market.

Tip 2 – Wait until the project is ready

Every green entrepreneur is going to be excited about their project, but it is important to wait until you have the capacity to scale up effectively. Previous applicants have downplayed the risks involved in growing their business. Make sure you submit a coherent and honest risk assessment, identifying all the technical and financial risks.

Tip 3 – Follow the IF Greenhouse gas methodology

Take advantage of the support provided by the fund, including a MS excel tool, to calculate your project’s emissions avoidance accurately and in line with best practice.

Tip 4 – You can’t do this on your own

Even although you and your team understand your project better than anyone else, it is important to get some outside perspective. Get a professional in the sustainability sector to review your application, making sure your claims are consistent and clear.

The full paper is available here:

https://ec.europa.eu/clima/system/files/2022-01/policy_innovation-fund_best_practice_en_0.pdf

Swiss Technology Fund

The Swiss government has established a cleantech fund to advance its climate goals set out in the CO2 act. The fund controls up to 500 million CHF and offers loan guarantees of up to three million CHF.

The government has chosen to partner with South Pole and Emerald Technology Ventures to act as subcontractors. They will manage the activities of the fund including processing applications and delivering the loan agreements with the banks.

Who is eligible?

Location

If you are going to apply you must have a presence in Switzerland and add value to the Swiss economy. However, that does not mean your company has to be Swiss-owned, you are free to apply as a subsidiary of a foreign parent company.

Candidate profile

In order to receive support from the Technology Fund, your project will need to be far along in its development journey. Unlike the other funds we have mentioned, which support projects in the formative stages of their development, this fund requires green businesses to have a product that is already generating sales.

Candidate firms looking to apply must make sure that they have investors to cover a minimum of 40 percent of their project costs. The loans from the Technology fund are only joint guarantees. The extra funding can be raised from a variety of sources including equity sales, in-kind contributions or other loan agreements.

Advantages of the fund

The Technology Fund has a couple key selling points which they hope will encourage green entrepreneurs to participate in the funding scheme. Firstly, the fund can secure loans at a favorable rate for your company. Typically the average rate of interest is between one and two percent.

Secondly, the funding from the Swiss government allows green entrepreneurs to get the crucial financial backing they need without surrendering equity in their business to the bank or other private investors. If you want to protect your ownership share in your company, it might be a good idea to pursue a mixed funding option between private and public backers.

Do you need some extra support to boost your sales? Take this quick test to confirm your eligibility for the Technology Fund? https://www.technologiefonds.ch/vorab-check

Good luck with your funding applications

Securing funding is not an easy task. However, with a growing number of funding opportunities opening up in the UK and Europe, we hope that all aspiring green entrepreneurs find a supportive partner to grow their business.

If you have recently been through the process of applying, either successfully or unsuccessfully, we at Kumēia would like to hear from you – editorial@kumeia.org.